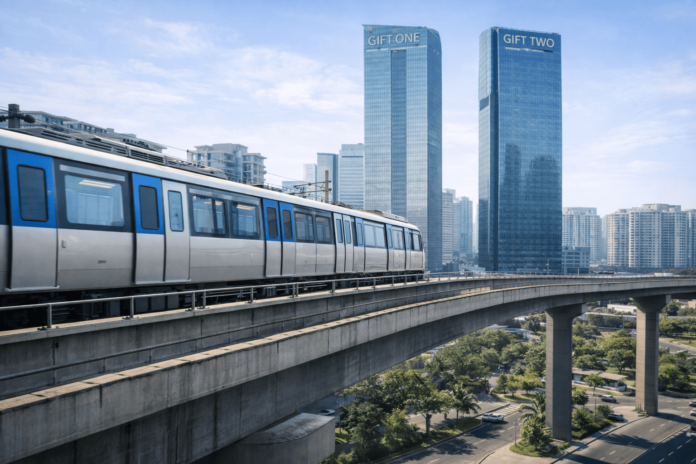

When investors talk about strong returns in structured business zones, Properties in GIFT City often enter the conversation. NRIs, in particular, are showing interest. Why? Because it combines infrastructure, policy backing, and long term economic activity.

But ROI is not magic. It depends on timing, asset selection, and strategy.

Let’s look at what really drives returns here.

Why NRIs Are Paying Attention

NRIs look for:

- Transparent processes

- Growth backed by economic activity

- Currency advantage

- Rental demand from professionals

GIFT City checks many of those boxes. It attracts financial firms, tech companies, and global players. That builds consistent housing demand.

For NRIs who want a foothold in India without daily management stress, this location feels structured.

Still, emotions should not drive investment. Numbers should.

Commercial vs Residential Returns

Commercial properties often offer higher rental yields. Long leases and corporate tenants create predictable income.

Residential units offer broader tenant demand. Young professionals, families, and executives all need housing.

Which one is better? That depends on your risk appetite.

Commercial may offer stronger returns but longer vacancy risk. Residential may offer moderate but steady rental flow.

Study current lease rates before deciding.

Rental Yield Calculation

Do not just rely on projected figures.

Calculate:

Annual rent minus maintenance and taxes

Divide by total investment cost

That is your real yield.

Many investors forget vacancy periods. Factor in at least one month of potential vacancy per year.

If the numbers still look solid, you are on the right track.

Capital Appreciation Potential

Returns do not come only from rent.

As more companies establish operations, property demand grows. When demand rises and supply stays balanced, prices usually move upward.

Look at:

- Upcoming commercial towers

- Infrastructure expansion

- Residential absorption rate

If occupancy is rising year after year, appreciation often follows.

Risk Management

Every investment carries risk.

Ask:

What happens if rental demand slows?

Can you hold the property for five to ten years?

Is your cash flow stable enough to manage EMIs without rental income?

If your answers feel uncertain, reconsider the size of your investment.

A cautious investor survives market cycles.

Using Digital Evaluation Before Buying

Many buyers now rely on digital assessments before finalizing units. An ai vastu analysis tool can help review layout alignment quickly. This matters for tenants who prefer vastu compliant homes.

If your property appeals to a wider tenant base, rental demand improves.

Technology does not replace due diligence. It supports faster screening.

Tax Considerations for NRIs

NRIs should review:

- TDS on property purchase

- Rental income tax

- Capital gains tax

- Repatriation rules

Work with a tax consultant who understands cross border rules. Small mistakes here can eat into returns.

Negotiation and Entry Timing

Early stage pricing in new developments may offer better entry points. But early stage also carries construction risk.

Ready to move properties reduce uncertainty but may cost more.

Which trade off works for you?

ROI improves when you enter at the right price. Even a small negotiation can impact long term gains.

Diversification Strategy

Putting all funds into one unit is risky.

Some investors split capital between:

- One residential unit

- One smaller commercial unit

That spreads risk across tenant types.

Diversification does not guarantee profit. It reduces exposure.

A Reality Check

Properties in GIFT City offer strong potential, but they are not lottery tickets. Growth builds over time. Investors who stay patient usually benefit.

Are you looking for fast profit or steady asset growth?

Answer honestly. Then plan your move based on data, not hype.

Smart investing is rarely flashy. It is consistent.